Gas prices spike, consumers bear the brunt

The pump gets pricier – well, at least it does at this Sunoco by the Travilah Square Shopping Center as of May 5.

The volatility associated with the price of a barrel of crude oil can be credited to a variety of geopolitical, economic, and industry-wide factors that no one person or organization has control over, though some have considerable leverage over others. Over the course of the past two and a half years, the price of gas has been through the roof and back before it arrived at its current national average of $4.29/gallon, per data YCharts derived from the Energy Information Administration. Let’s go back in time and take a look at the roller coaster that is the price of gas.

COVID and OPEC+

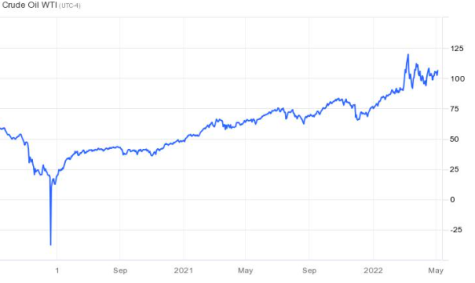

A world that was shut down as a result of the pandemic finds less use for oil and gas. Cars wouldn’t drive, restaurants wouldn’t cook, and airplanes wouldn’t fly. So what happens when the demand for a product decreases? The price follows suit, as best observed with the below chart:

(Price of a barrel of Crude Oil from January 2020 to May 2022 from tradingeconomics.com)

The sharp drop in oil prices between March 2020 and mid-May 2020, though, was also fueled thanks to a Russian war. In this case, a price war. The Organization of the Petroleum Exporting Countries (OPEC) is a group of countries that coordinate oil production and output to influence worldwide oil prices, increase those countries’ revenues, and boost their economies. Russia was a member of the informal OPEC+ group that looked to further control the world’s oil supply. In the face of lowered demand and lower oil prices, the hope was that OPEC and the unofficial members of OPEC+ would cut supply to keep oil prices steady. In hopes of increasing their market share, Russia and Saudi Arabia refused to budge, leading to an oversupply of oil when demand remained tight, leading to the ensuing crash of the price of oil.

So who finally prompted Russia and Saudi Arabia to limit production? Donald Trump. It was a first in the sense of a U.S. president negotiating to reduce oil supply. The agreement he helped formulate with OPEC+ limited oil supply and led to a cut in production of crude oil by 9.7 million barrels a day to help stabilize oil prices and prevent a “tank top,” where oil storage tanks run out of room to store more oil. The agreement went into effect in April 2020 and stayed in effect until April 2022, which proved to be unfitting for the events that would follow over the course of the next couple of years.

Reopening, inflation, and the Russo-Ukrainian War

Of course, the world wasn’t going to stay locked down forever. But while it did stay shut down, the federal government and Federal Reserve took measures to limit the effects of the recession brought on by COVID. Part of the recovery in oil and gas prices came from this unprecedented fiscal and monetary stimulus to juice the economy and bring it out of the COVID recession. But lockdown fatigue was getting overwhelming after a year of being stuck at home. So what did people do as the world reopened and they had new COVID stimulus checks to burn? They went out. And they’re still going out. Passengers are flying again, people are driving places, and consumers are eating out. And what is it that fuels the Boeing for the roundtrip to Disney World? It’s the same thing that most cars run on, and the same thing that turns the stovetop at restaurants on. In fact, as we see now, those fiscal and monetary policy measures were perhaps too aggressive and may be contributing to record inflation rates. It’s increasing the cost of everything. That includes oil.

And then came the Russian invasion of Ukraine.

Remember when we mentioned that Russia was a member of the informal OPEC+ cartel to help further influence worldwide oil prices and supply? Well, they actually produce 11% of the daily worldwide oil supply, and, more specifically, Russian oil makes up some 27% of the EU’s crude oil imports. In terms of natural gas, Russia’s grasp is only stronger, where Russian gas makes up around 40% of the EU’s total gas consumption. That’s one of the reasons Europe has been having such a hard time breaking up with Russian oil – its economy is awfully dependent on it. Fears over a possible Russian oil ban as repercussions of the invasion of Ukraine drove the price of oil up to multi-year highs. Some states, including Maryland, have passed suspensions to their gas tax in an effort to calm down the price of gas with limited success. For the most part, however, on occasions like these, there are no winners. Consumers lose, politicians lose, the economy loses.

Well, maybe not everybody.

If Europe wants to reduce its dependence on Russian oil, it needs to get it from somewhere else. The hope is that U.S. oil companies will be attracted to multi-year high prices that will encourage them to drill more oil and gas to export at those higher prices, while increasing supply and slowly decreasing and stabilizing the price of oil. Oil executives, however, and especially investors in big oil, aren’t optimistic about the medium- and long-term price of oil staying high for long. The U.S. shale industry, bearing high production costs that require a breakeven price of between $50 and $55 per barrel of oil, had been bleeding cash and incurring losses for years. Now that oil is back to its glory days (no matter how short), big oil is looking to keep their bottom line in check and investors filled with glee. And the harsh reality is that the outlook for oil over a five- to 10-year longer term is not looking profitable as the world looks to transition from fossil fuels to renewable sources of energy. The fear over future prices going down, along with the OPEC+ deal formulated by Trump that only expired at the end of April 2022, is part of the reason that worldwide production of oil still hasn’t reached the levels it had seen from the Russian-Saudi Arabian oil price war as seen below:

(3-year crude oil production in millions of barrels is provided by YCharts.com)

For now, the only thing that can be done is watch (at least from our side). So long as big oil won’t budge on oil production, Russia won’t restrain their invasion, and consumers don’t stop traveling, each visit to a local Shell, Sunoco, or other preferred gas station might just get pricier and pricier.

Your donation will support the student journalists of Thomas S. Wootton High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Joaquin Moreno is a 2022 graduate.