Income inequality worsens due to COVID-19 pandemic

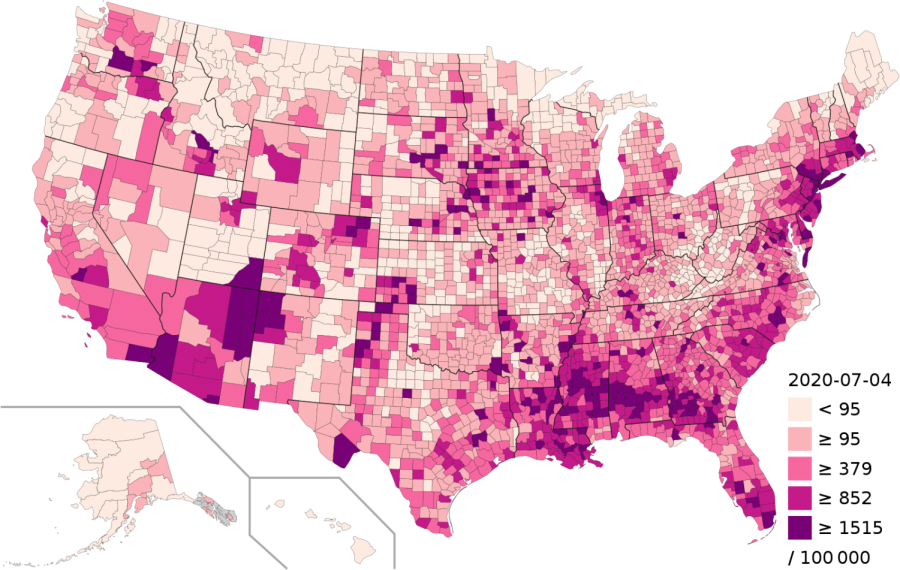

A COVID-19 Outbreak Map of the USA, per 100,000 residents for each county.

It is no secret that the recent COVID-19 pandemic has had a significant effect on the United States.

One of the most important impacts this event has had is the economic impact. According to the US Bureau of Economic Analysis, “Real gross domestic product (GDP) decreased at an annual rate of 31.7 percent in the second quarter of 2020, according to the ‘second’ estimate released by the Bureau of Economic Analysis. The change was 1.2 percentage points higher than the ‘advance’ estimate released in July. In the first quarter of 2020, real GDP decreased 5.0 percent.”

The virus has caused the most devastating collapse in recent years over just three months in 2020, altering nearly five years of economic growth, according to Ben Casselman of the New York Times in his article “A Collapse That Wiped Out 5 Years of Growth, With No Bounce in Sight”.

This economic decline has severely affected the general public. According to Jay Shambaugh of Brookings, “It appears that millions of Americans have already lost their jobs, likely at a pace that exceeds job losses in the worst weeks of the Great Recession.”

This mass unemployment has had a disproportionate impact on lower-income adults and certain specific demographics. Approximately 61% of Hispanic adults have reported a job loss or pay cut as a result of COVID-19, a study performed in April by the Pew Research Center claims.

Some members of groups such as college graduates, white adults, and people over the age 65 do have access to “rainy day” funding that can support them for a short amount of time, but about two-thirds of Black or Hispanic adults, those under age 30, and people without college degrees have reported that they do not have access to this type of rainy day fund.

The Pew Research Center study claims that “Most adults who don’t have emergency funds would have a hard time accessing funds to cover basic expenses if they lost their income. Of the 53% of adults who say they don’t have rainy day funds set aside, most say they wouldn’t have easy access to money that could help them meet their financial obligations if they lost their main source of income. Only 28% say they would be able to cover their expenses for three months by borrowing money, using savings, selling assets, or borrowing from friends or family. About 71% say they would not be able to do this.”

Furthermore, according to ABC News, experts claim that the pandemic is not only worsening the financial conditions of the already poor. Although they claim that extreme inequality was always present in the US, the pandemic can only make the situation worse. Although Congress has attempted to boost unemployment benefits, the situation is still highly problematic.

“The pandemic crisis will widen the already worrisome levels of income, racial, and gender inequality in the U.S.. This engenders an element of a vicious circle at work: not only will the pandemic and its fallout worsen inequality; inequality will exacerbate the spread of the virus, not to mention undermine any ensuing economic recovery efforts,” Dimitri Papadimitriou, President of the Levy Economics Institute at Bard College, and former Greek Minister of Economy and Development said in the ABC News article.

The redistribution of wealth during the COVID-19 pandemic has only served to reinforce and worsen the situation of economic inequality in the United States, hurting lower-income workers and minority groups, while simultaneously having a negative impact on the quality of life of the entire nation.

Your donation will support the student journalists of Thomas S. Wootton High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Elliot Wang is a 2021 graduate.