A student at the age of 16 decides to invest hundreds of dollars through the next decades of his life. Looking for long-term success, they study algorithms, manage their money and pick the most reliable stocks to invest in. Roughly 40 years later they look back at the investments they began to make when they were a student. Did it pay off? Or did they waste thousands of dollars and the time they spent?

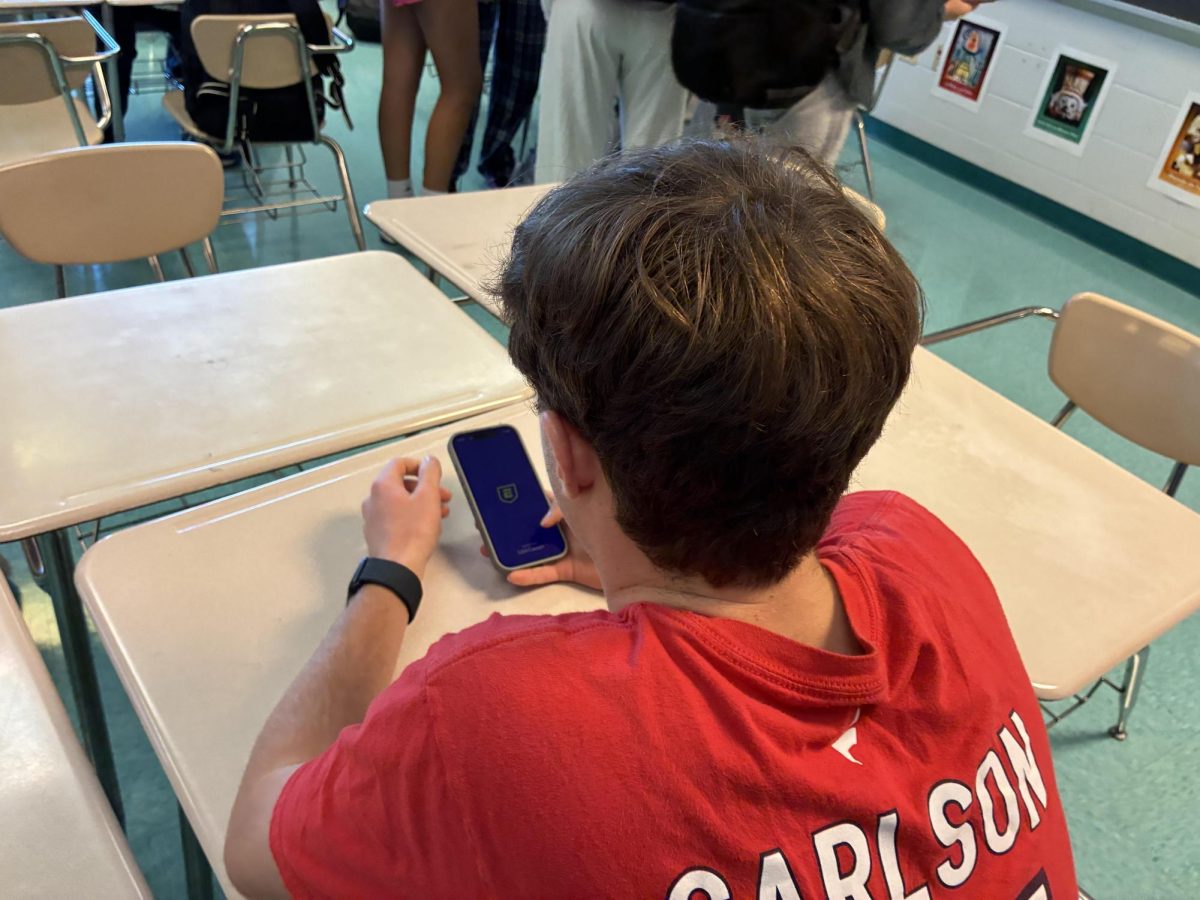

Junior Krish Balkee began his Wall Street journey a few months ago. While unsure of how it would turn out, he knew what his goals were. With guidance from sources online and his peers he singled out certain stocks to invest in and decided to strike a chance on changing the trajectory of his financial dreams. “My goal with the stock market would be to triple my money in the span of a year,” Balkee said.

With any investment comes risks. Finance and history teacher Chris Thompson said he believes that when it comes to investing, thinking long term is the most safe. “I think most people that do day trading don’t make a lot of money and [investing] is a long-term thing,” Thompson said.

In Balkee’s mind, preparing for the future is important not just for financial reasons, but also to learn real-world skills. He said that if he wants to relate his career to finance, understanding the market would help him learn economic cycles and the importance of time. “I plan on becoming an investment banker when I am older and the stock market allows me to develop key skills early,” Balkee said

According to Balkee, students often think stocks are for professionals, but he believes they can be for anyone. His dad encouraged him to invest and he began his journey. “My dad gave me the idea to invest, he set up my bank account and educated me on how the stock market functions,” Balkee said.

Thompson said that investing is not something that a person can easily pick up. Investing is not gambling: you have to make decisions that require much thought and understanding. “You have to know what you are doing and have to understand the companies [that you will invest in],” Thompson said.

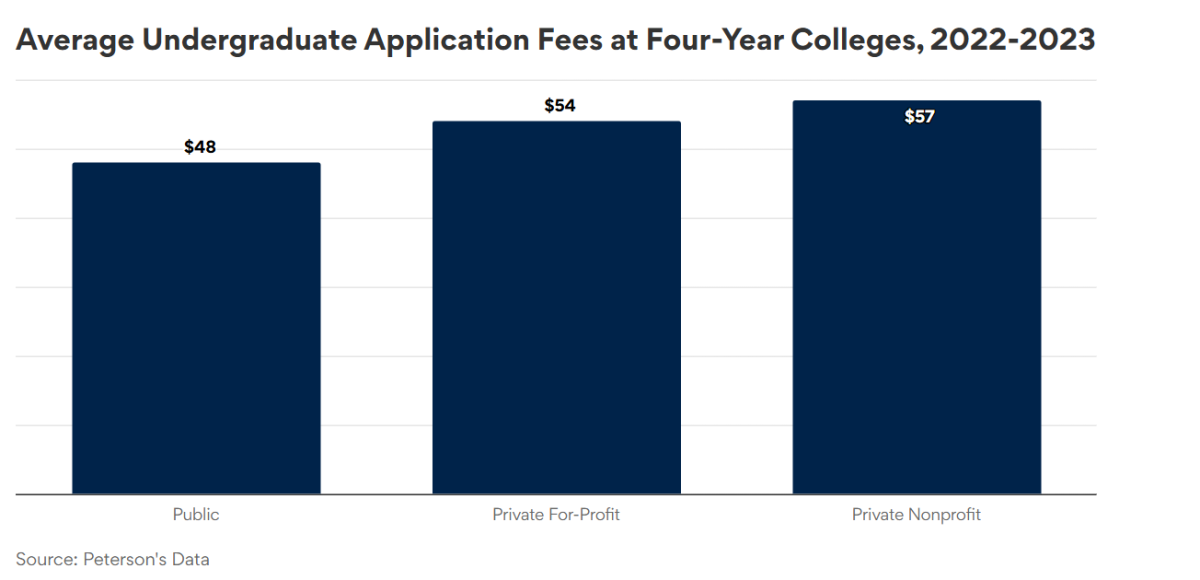

In a harsh economy teenagers worry about their future and how their financial situation could end up. A study done by Fidelity (Link to article), a major financial company, shows that “the majority of teens (75%) aged 13-17 say investing is important to them, but fewer than one in four (23%) have actually started.”

While other students such as senior Maddy Mathew do not invest, it is because they are unaware of how the market works. If students were taught, they may consider investing in the stock market. “I do not invest because I don’t understand how it works. If I learn more about it maybe I will,” Mathew said.

![Editors-in-Chief Ahmed Ibrahim, Helen Manolis, Cameron Cowen, Alex Grainger, Emory Scofield, Hayley Gottesman, Rebekah Buchman and Marley Hoffman create the first print magazine of the year during the October press days. “Only a quarter of the schools in MCPS have programs that are like ours, a thriving, robust program. That makes me really sad. This is not just good for [the student journalists] to be doing this, it’s good for the entire community. What [student journalists] provide to the community is a faith in journalism and that continues for their lifetimes," Starr said.](https://woottoncommonsense.com/wp-content/uploads/2025/10/wmpoFTZkCPiVA3YXA4tnGoSsZ4KmnKYBIfr18p3l-900x1200.jpg)